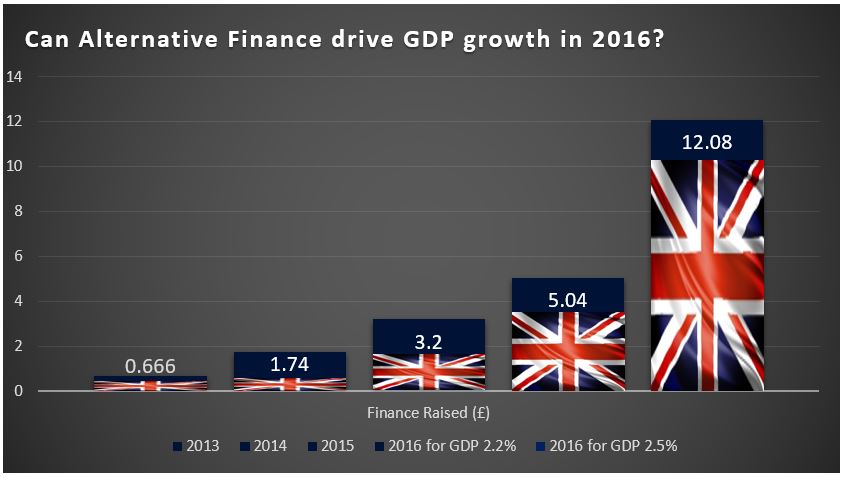

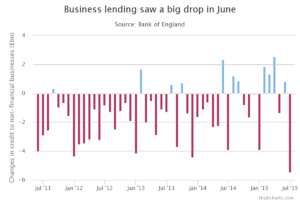

The Bank of England revealed last week that lending to SME’s had dropped in the final three months of 2015 to £599 billion, down from £755 billion last September. Tradition dictates that businesses do not tend to borrow money around Christmas, and those that try are viewed as desperate. Yet these are big numbers: the £156 billion difference from Q3 to Q4 is over 31 times the £4.94 billion all-time figure Nesta estimations that P2P Lenders had facilitated for SMEs. The fact of the matter is that the banks aren’t lending to up and coming businesses that drive the economy, and an increasingly large vacuum is emerging.

The government, keen to plug this gap, had put the “Funding for Lending” scheme in place, in which the banks are offered cheap loans from the Bank of England that are aimed to reach small businesses. Clearly the scheme isn’t working: the Bank of England’s data for the Q4 of 2015 revealed that £6.3 billion (an increase of 262% on the previous quarter) had been borrowed by the bank in the same period. Unless that is going to filter through to all the SME’s in Q1 2016, where is that money going?

The emergence of challenger banks such as Aldermore, Shawbrook and Metro Bank has seen the big banks distance themselves further from SMEs. Aldermore announced that they’ve lent £6.1 billion in 2015, making them the third largest lender on the Funding for Lending scheme. Similarly Shawbrook’s loan book grew 44% to £3.36 billion in 2015 (to put that into perspective, that’s more than the entire P2P Lending industry managed in 2015). These figures are still just a drop in the ocean, however, and it is still very much a case of “if” not “when” UK SMEs are receiving the kind of funding that can help them drive GDP in the near future. In the long term, however, it will be alternative finance that steps in alongside the banks, providing a stable working relationship between the two is maintained.

The banks are already starting to turn to alternative finance platforms who are keen to facilitate funding to both consumers UK SMEs. Funding Circle, for instance, receive referrals from RBS and Sanatander and back in May, Zopa and Metro Bank announced a deal whereby the bank would lend money across their platform to consumers. The trend will continue but the traditionally clunky banking processes are reflected in building the working relationships: banks like to take their time and tend to cherry pick. It is no surprise that only the two bigger players in the UK market have formal partnerships. The emergence of so many Peer to Peer lending platforms, though, specialising in such diverse and niche products, has meant they simply can’t keep up. And if they can’t beat them, they will start to join them in swathes.

Zopa CEO Giles Andrews has said in the past that they don’t allow any institutions to do their own credit analysis on those customers, something that seems unbelievable, given the depth the banks go into even just to set the relationship up in the first place. Furthermore, it’s not as if Zopa can stop anybody carrying out their own credit analysis, especially one of their potentially biggest institutional lenders. But his attitude in general is right: if the banks want to lend to consumers and businesses through alternative finance providers they should be treated the same as all other lenders. It is a democratic process after all.

The lull in funding for SMEs since the credit crunch of 2009 continues, but not for long. Alternative Finance is here to help, and if the banks want a piece of the action they will have to do so on the same terms as everybody else.