Risk Warning

Don’t invest unless you’re prepared to lose money. This is a high-risk investment. You may not be able to access your money easily and are unlikely to be protected if something goes wrong. Interest payments are not guaranteed, if the Borrower defaults we offer no assurances that capital can be recovered. Historic returns and loan default rates are not necessarily indicative of future returns and future default rates. ISA eligibility does not guarantee returns or protect you from losses. Lending over the ArchOver platform is not covered by the Financial Services Compensation Scheme. please read our P2P Guide.

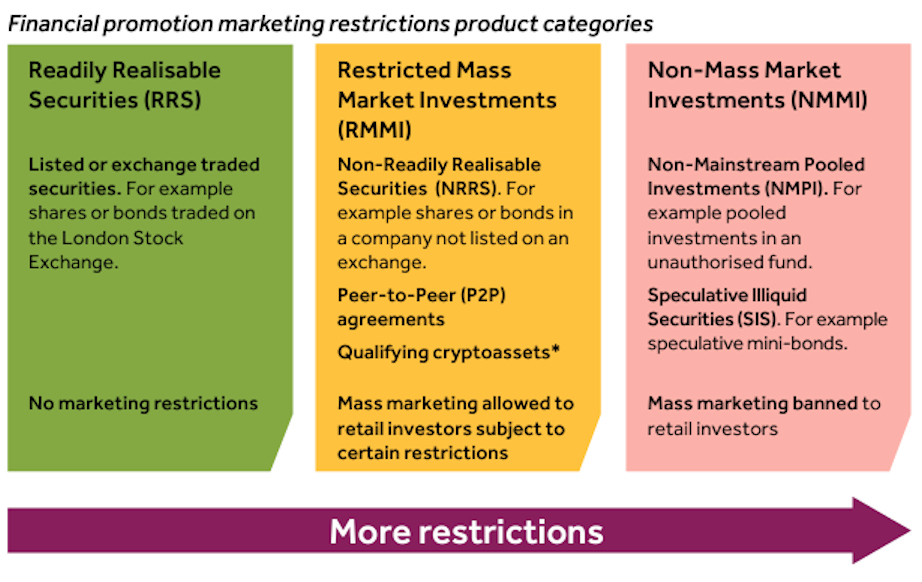

This investment is classified as a ‘Restricted Mass Market Investment’ which means it has been classified by the Financial Conduct Authority (FCA) as more risky than ‘Readily Realisable Securities’

ArchOver is not a bank. We are not part of the Financial Services Compensation Scheme. When your capital is lent to a Borrower it is not covered by the Financial Services Compensation Scheme in case of failure of the Borrower.

This is a general risk warning. There may be other risks that are relevant to you as a Lender or relevant to particular projects on the ArchOver platform and you must carry out your own research in addition to information provided by us. If you are unsure of the risks, you should either seek professional advice, or avoid investing across this platform.

Lending over the ArchOver platform you are:

- Lending your money direct to UK businesses, you are not Lending money to ArchOver

- Accepting the risk that businesses you lend to may fail

- Accepting that there is no guarantee that any interest you are expecting will be paid

- Accepting that there is no guarantee that your capital will be repaid, and you may lose all of the capital you have invested

- That any security in place may not cover the capital you invested and that security enforceability can fail

- Committed to lending for the full duration of the loan; there is no opportunity before maturity to sell your portion of the loan

The ArchOver platform facilitates both secured and unsecured loans over its platform. Secured loans offer the most security, while our Advance services offer little or no security at all. The greater the risk, the higher the lender interest earned. For more information, please visit Defaults, Recoveries & Losses.

ArchOver’s Solvency

As an FCA authorised and regulated business, ArchOver is required to maintain capital at mandated levels. However, there is a risk ArchOver may become insolvent and is unable to continue trading. In this event, the FCA has mandated that we have an alternate who can administer the loans made, through to maturity.

ArchOver's Wind Down Procedures

All peer-to-peer platforms must have ‘wind-down’ plans in place if the business cannot continue/fails.

ArchOver is part of the Hampden Group of companies. Hampden operates in the highly regulated Lloyds insurance market as well as owning Hampden Private bank and numerous other financial services firms, including expertise in run-off/wind down services.

We believe it is in the best of interest of our Lenders and Borrowers that Hampden Group is contractually bound not only to provide ‘wind-down’ services but must also ensure ArchOver remains operational and FCA regulated through the term of any ‘wind down’ and ‘run off’ of the loan book.

Lenders: Don’t invest unless you’re prepared to lose money. This is a high-risk investment. You may not be able to access your money easily and are unlikely to be protected if something goes wrong. Interest payments are not guaranteed, if the Borrower defaults we offer no assurances that capital can be recovered. Historic returns and loan default rates are not necessarily indicative of future returns and future default rates. ISA eligibility does not guarantee returns or protect you from losses. Lending over the ArchOver platform is not covered by the Financial Services Compensation Scheme. Take two minutes to learn more and please read our P2P Guide .

ArchOver Limited is a company registered in England and Wales with company number 07235487. ArchOver Limited is authorised and regulated by the Financial Conduct Authority (Reg No: 723755).