Thought provoking piece in CAPX by Jamie Whyte challenging the new “intellectual protectionists” who, unless we are careful will stifle change and growth, make everything cuddly and bankrupt us in the process. If we accept only the perceived wisdom of today and make it an offence to suggest anything else, yes some supposedly clever people really have suggested that we’ll stagnate.

Contrast the approach of making denial of climate change a criminal offence, with the active approach taken by the FCA to P2P lending as reported in Business Insider. The ingenuity of a lot of people is being encouraged and a sector carved out of the banking industry, which is and will continue, there’s an awfully long way to go yet, to provide better service to consumers. Of course the real contrast for the FinTech sector is not with the polar bear, but between the US and the UK. The UK has the white heat of the revolution, echoes of Coalbrookdale from an earlier industrial revolution, and with continued acceptance of new ideas by regulators and financiers will keep it.

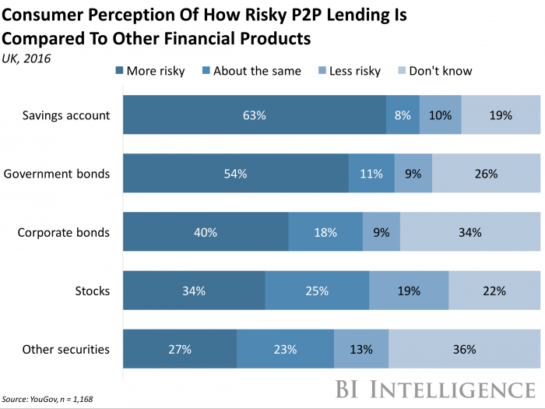

I’m not suggesting that everything is perfect, rightly there is concern that lenders (or investors in FCA speak) fully understand the risks they are taking. A recent survey suggests that the message is being heard. As a sector we need to continue to reinforce the message heard by those in the dark blue sectors and work, with the FCA, on the lighter blue. What we need is continued consultation, a continuation of the active approach to regulation and a fuller analysis of the security provided by P2P lenders. A move away from a concentration on the nebulous and usually unquantifiable concept of risk to security provided.

For the record I don’t deny climate change, it is real, although I suspect it and its effects have been overstated. As for Germaine Greer, see the CAPX article, I agree with little she says and she has an absolute right to say it and to be heard. Only by hearing can we be challenged to change and develop and yes this may at times be very uncomfortable and much less than cuddly. C’est la vie.