Switzerland is widely recognised as having one of the most independent, prosperous and stable economies in the world, which is why for decades nervous investors have regarded the country as a safe haven for their money in times of global turbulence.

In 2014, when Russia was facing huge problems and money was pouring into Switzerland chasing up the local currency, the Swiss National Bank surprised the world by dropping the domestic Base Rate to minus 0.25% in a determined effort to weaken the value of the Swiss Franc because it was damaging the country’s export effort. Today, and for the same reason, Switzerland’s Base Rate stands at minus 0.75%.

Although the Swiss economy has had two relatively sluggish years in 2015-16, it is expected to grow by around 1.5% in 2017. Yet Bond yields remain at minus 0.19%, which hardly provides rich pickings for local yield-hungry investors who, per capita, are reckoned to be the world’s wealthiest.

Back in the UK, we have a parallel situation regarding low fixed interest returns and following our decision to leave the EU – an organisation with which, of course, Switzerland has never been integrated – we are moving to a position where we will have even more in common.

The one crucial difference from an investor’s point of view is that the UK has developed some attractive alternative asset forms, such as P2P loans the demand for which is booming. Yields of 6% and more are commonplace which, bearing in mind the relative security provided by the larger platforms through provision funds or, in ArchOver’s case, credit insurance, represents something approaching a decent return.

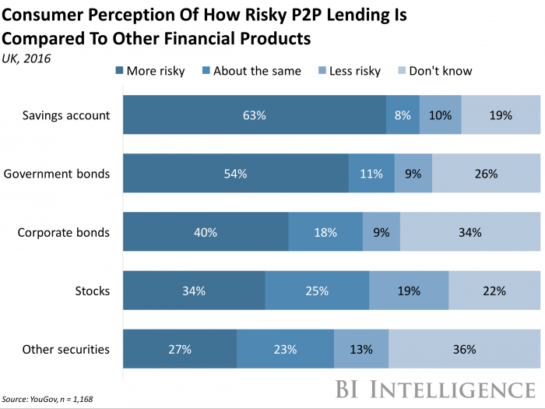

No one is pretending that P2P loans are risk free – of course capital can be at risk – but many individuals and institutions have decided that, given all the information available, the transparency and free entry for investors to participate, the overall odds are worth accepting.

As ever, investment timing is vitally important. Sterling, which took such a battering following the Brexit vote, is slowly recovering and is expected to rise in value against currencies like the Swiss Franc. In the meantime, the lower value of our currency is doing wonders for our exporters and the UK economy is now expected to grow. All things considered, and bearing in mind that low interest rates look like being part of the financial landscape for the foreseeable future, now would seem to be a very good time to invest in UK PLC – leave it too late and you could ‘miss the bus’.