ArchOver has teamed up with The Telegraph to produce a series of articles to help educate investors on the UK Peer-to-Peer Lending sector. In a brave new economic and financial world, understanding different ways of managing your money is key to success. P2P Lending can help both individuals and businesses navigate a post-Brexit world, with the reassurance that it is a secured and effective method of protecting and growing your money.

Getting a good return on your investments is more crucial than ever as you approach retirement.

With the base rate at record lows and living costs high, putting together a nest egg is difficult while you are working. What’s more, when working people begin to approach retirement, they are often encouraged to switch their investments into lower-risk assets, a process known as “lifestyling”.

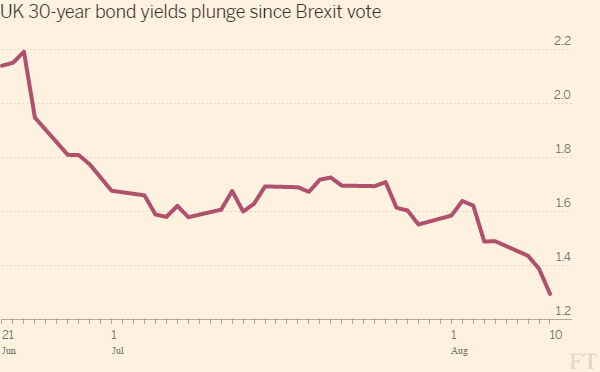

This can further decrease the chance of a good pension pot because these lower-risk assets, such as government gilts, often provide very low returns.

Making it last

Once pensioners reach what is called the “decumulation phase” – when they retire and start to use their savings to live on – the problem continues.

Unless they buy an annuity, which gives a guaranteed lifetime income, pensioners must use their nest egg to meet their living costs for the rest of their lives. And annuities are by no means fail safe – rates have halved in the past 10 years and unless pensioners continue to invest and gain returns, their pension pot is likely to fall in value due to inflation.

With this in mind, investors must consider all the options to ensure their pension saving is adequate and that they make the most of their savings approaching retirement without taking undue risk.

1. The traditional route

A portfolio of shares and bonds or funds is a traditional option.

Returns on a share and bond portfolio will vary, and the value of your money can go up as well as down. Choosing shares that pay dividends can help to swell your nest egg over time. The latest Barclays Equity Gilt study shows that the average share investment would have returned 2.3pc per year after inflation in the past 10 years, with bonds returning 3pc.

2. Buy-to-let

Buy-to-let property has been a popular option for pensioners wanting to make the most of their nest eggs. However, a raft of tax changes including higher stamp duty on second properties and a phasing out of buy-to-let tax relief makes this less attractive.

There are also costs associated with buy-to-let including budgeting for void periods. Rental yields can be high, with recent figures from Lendinvest showing that buy-to-let hotspots including Gloucester and Blackburn have yields at over 4pc.

3. Peer-to-peer lending

Peer-to-peer lending is another option, which may produce a higher return, but also puts your capital at risk. Peer-to-peer sites lend money to individuals or businesses and can offer rates of up to 7pc.

Different peer-to-peer sites offer different forms of security for your cash and different lending models, so it’s important to understand how the system works.

ArchOver, which specialises in business peer-to-peer lending, offers rates of between six and seven per cent, and lenders can tie up their money for as little as three months – although 12 months is more likely.

Angus Dent, chief executive at ArchOver, says he believes the product is suitable for pensioners who have done their homework and who could use peer-to-peer lending as part of a diversified portfolio. “Our oldest lender is in his 90s,” he says.

How ArchOver Works.

ArchOver matches lenders and borrowers so that lenders earn a competitive rate on their money and borrowers can get the money they need for their business to grow. As well as doing their own due diligence on the companies on their platform, loans made through ArchOver are “secured and insured”.

The security policy involves ArchOver, on behalf of its lenders, having the first right to the Accounts Receivable of each borrower, which they are required to keep at a level of 125 per cent of the loan. ArchOver’s charge over the Accounts Receivable is registered at Companies House. A secondary policy requires the borrower insuring the Accounts Receivables – the money owed by their customers for goods and services that have already been delivered – against the loan.

If a customer of the borrower pays unduly late, or doesn’t pay at all, the insurance company pays out to the lender.