Perilous Times For Pension Pots… Not Necessarily

A choir formed of politicians, journalists and disgruntled employees continue to call for Sir Phillip Green to get his cheque book out to plug the £700m pension deficit at BHS. The once well regarded retail magnate sold the now bust British department store for £1, but not before he and his shareholders paid themselves more than £400m in dividends. It is unlikely that Green – worth an estimated US$5.7 Billion – will sort out this mess; and so blameless pensioners who can ill afford to lose a pound will be left out of pocket. Sadly, this tragic story is no anomaly; 130,000 Tata Steel employees stand to lose a quarter of their retirement income. The devastation that this will inflict on families, from Tyneside to Port Talbot, is huge and will last at least a generation.

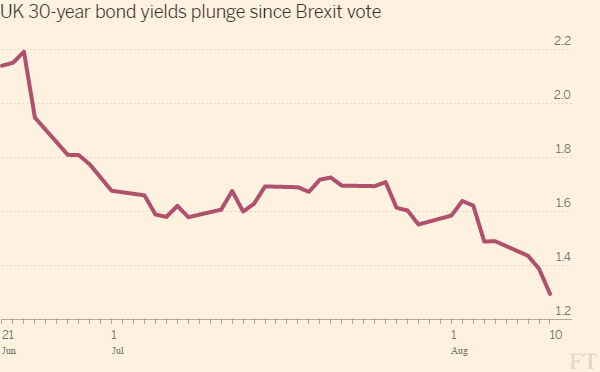

Corporate irresponsibility can cripple pension funds, however it is the Bank of England’s latest move – cutting interest rates and beginning a new £70bn quantitative easing programme – that will cause pensioners considerable pain. By buying gilts – instruments pension schemes use to value their liabilities – the BoE is forcing yields down. “The UK’s benchmark 10-year borrowing rates touched a new low of 0.51% last week; while short-dated gilts due in March 2019 and March 2020 briefly traded below zero” (The Financial Times, 2016). As a result, we are now running a £1.3trn deficit on private pension funding, with 56 FTSE-100 firms in arrears with their defined-benefit pension schemes (MoneyWeek, 2016).

(Source: The Financial Times, Aug-10, 2016)

According to David Blake from London’s Cass Business School, “The Bank of England clearly believes that the effect [of low interest rates] on our pension system is acceptable long-term collateral damage”. Indeed, until monetary conditions normalise, the outlook for retirees will remain gruesome. There is, however, a faint glimmer of hope. A beacon around which pensioners and savers alike can rally to make impressive returns. P2P.

Thanks to the ‘freedom and choice’ introduced to Britain’s pension systems, you can invest in P2P through a Self-Invested Personal Pension (SIPP) and soon via ISAs. If you’d like to take control of your pension pot, earn above average interest, and enjoy substantial tax benefits – all the while helping great British businesses grow – investing through a SIPP one of the P2P platforms could be for you. Rates of interest vary as do levels of security, careful research will indicate which platform and it could easily be more than one best suits your needs. Next week ArchOver will release a step-by-step guide, detailing how SIPPs work, who can set one up (anyone), and how you can use this flexible investment product to invest in P2P.

The p2p sipp from what I can find it totally geared to wealthy high earners with huge pots to transfer due to the large fees. I will be looking forward to your blog to see if anything has changed my views