An old adage that features regularly on this blog is that “SMEs are the lifeblood of the UK economy” and provide the primary driving force for growth. The capacity for SMEs to outperform the market is a factor, but a host of global permutations aligned to the plunging oil price and the Chinese equity “realignment” have curtailed certain growth expectations in the UK despite our healthy performance relative to the rest of Europe.

So, in light of Mark Carney’s recent revelation that the Bank of England had cut its growth forecasts for 2016 and 2017 from 2.5% to 2.2% and 2.6% to 2.3% respectively, here is a theoretical look at whether SMEs could make up the 0.3% difference, financed only by sources of alternative finance. The £5.5 billion of finance facilitated by P2P Lenders and Crowdfunders to date (2013-2015) is just a drop in the ocean, despite last week’s comments from a bewildered and misguided Adair Turner trying to convince the public that “The losses on P2P lending that will emerge within the next five to 10 years will make the bankers look like absolute lending geniuses …..”. Let’s just put things into perspective; Adair Turner failed to predict the sub-prime mortgage crisis when he was Vice-Chairman of Merrill Lynch between 2000 and 2006. By 2008, the bank had lost $51.8billion from mortgage backed securities. I won’t be asking him to read my palm any time soon.

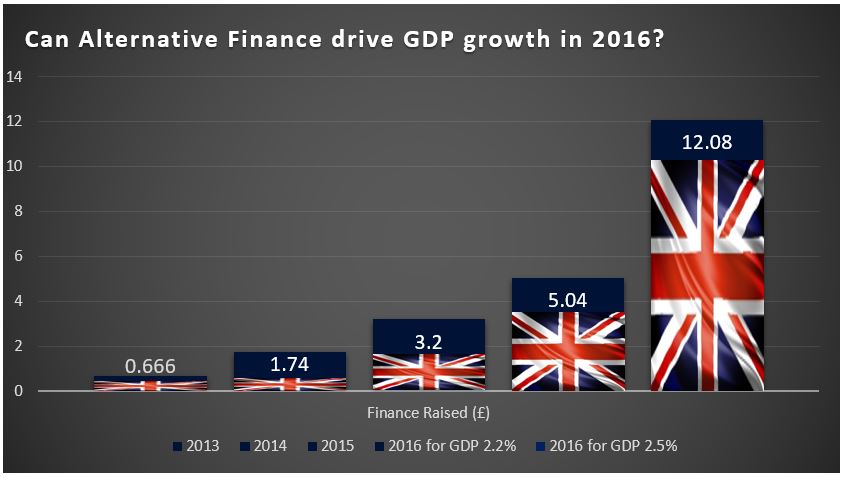

A quick outline of the sums: the UK’s GDP was measured at $2.9889 trillion in 2014. It grew by 2.4% in 2015 (according to the World Bank). The 0.3% downward swing in Carney’s growth projections for 2016 (2.5% down to 2.2%) is worth around $10.1 billion, which converted to GBP is around £7.04 billion. 2014 saw growth of 161% for the alternative finance sector; The Telegraph was quick to point out that growth had “slumped” to 84% for 2015, although in such a young industry there will be skewed statistics early on. Nesta’s 2015 UK Alternative Finance Industry report has projected between 55% and 60% growth for 2016; a 57.5% growth rate will see the industry lend £5.04 billion. This figure will have to be included in my 2016 GDP projections, meaning the alternative finance sector in 2016 would have to grow 337.5% to £12.08 billion from £3.2 billion 2015 to make up the 0.3% of GDP lost in Carney’s latest finger in the wind. And that is assuming that all of the other facets that make up GDP remain true to prediction. See the graphic below for an illustration of the figures:

So, what can we take from all this? Firstly, whilst the figures aren’t exactly astronomical, nobody in their right mind would guarantee such a large jump in the space of a year. But crucially, the potential is there for alternative finance to really make a difference in driving GDP growth through helping SMEs, the lifeblood of the economy. As banks and platforms start to work together, we will see the industry continue to grow at steady rates, and the money lent to SMEs help drive economic growth. The industry should at least be aiming for that extra £7 billion for 2016; with a push anything is possible.