[avatar user=”Hugo” /]

In the UK there has been a notable shift in the P2P Lending model over the last year towards increased involvement from institutional investors. The UK market is sometimes said to be two years behind the US P2P market, and this statement certainly holds true when it comes to attracting funds from this class of investor. Indeed, in the US it is estimated that around 80% of loans made through the two largest platforms, Lending Club and Prosper, are currently taken by institutional investors replacing the retail lenders that previously dominated the space.

There are two principal explanations for this shift beginning to occur in the UK: firstly, institutions are seeking access to new asset classes, and secondly, institutions see in P2P a scalable opportunity. Return is also key. With record low interest rates, volatile stock markets, and low bond yields, the P2P lending space offers investors the chance to earn considerably better returns without a proportionate increase in risk – an undeniable positive.

Thus far there have already been some high profile institutional involvements. In October, Eaglewood Capital finalized a $75 million securitization of P2P loans that were originated by Lending Club. In addition to this, Funding Circle has done a deal with KLS Diversified Asset Management, a US fixed income fund, to lend £132 million to UK businesses. This is the first time a US investment firm has lent money to British business on a P2P platform, further proof that the UK lending model is following the trends in the US but also that institutional money in the UK is not solely limited to UK institutions.

There is an obvious argument that institutional involvement could signify the end of ‘P2P’ and the ‘democratisation of finance,’ but in the author’s opinion this is simply not the case. Firstly, institutional involvement signifies an extra layer of due diligence, a form of due diligence that individuals are realistically unlikely to have available. This allows individuals to follow the smart money. Furthermore, the weight of additional institutional capital allows for larger loans to be funded over platforms, allowing more businesses to gain access to the financing they are sorely lacking. Lastly, it allows platforms to scale and reach targets at a far superior rate to relying on retail investment alone. In short, everyone’s a winner.

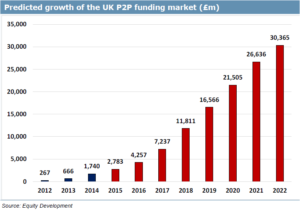

So whilst institutional money may currently represent only 30% of P2P funds in the UK, I expect that figure to be much, much higher in 2015.