[avatar]

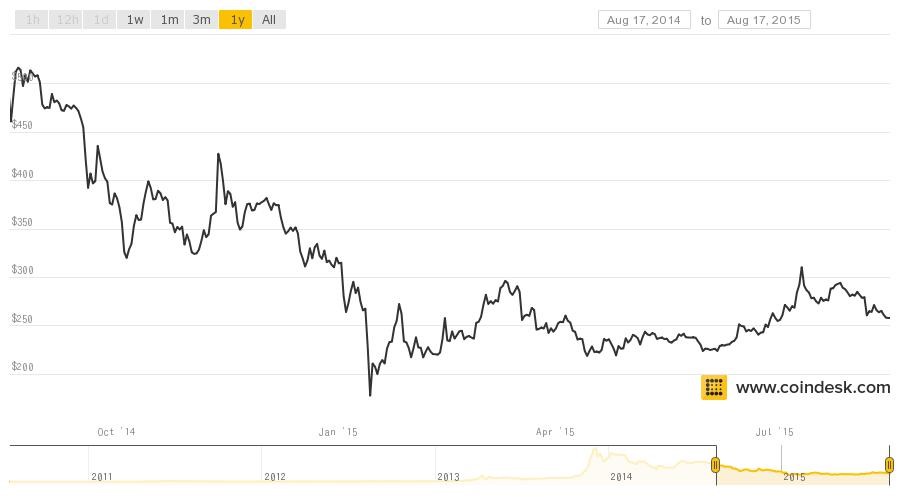

I am aware that there are other cryptocurrencies available on the web, but for the purpose of keeping this article short I have decided to focus on P2P platforms that use Bitcoins. The leading cryptocurrency in terms of worldwide market value, it has been a rocky ride to say the least in its short life to date.

What is Bitcoin? Bitcoin defines itself on its website as “the first decentralized digital currency, directly transferred from person to person without going through a bank.” Advantages include very low processing fees, no frozen bank accounts and worldwide payments. The currency is secured by a group of individuals called miners, who verify transactions in return for newly generated bitcoins. Traditionally, currency valuation is based upon confidence; the assurance that the central bank is good for the money and promises to pay the bearer on demand. The miner system has been exploited in the past; cybercriminals have a very well-established, tested, and long-operating mechanism to perform marginal-cost distributed computing in the form of botnets, which are undermining the currency’s value by enabling them to produce illegal bitcoins.

Another major downside to date has been the currency’s volatility. In its initial stages, bitcoin was still classed as an asset that received bad press due to its link with illegal websites such as The Silk Road. As its reputation and distribution has grown, it has been affected by factors similar to all fiat currencies, as fluctuating perceptions of how to correctly value the currency continue. In the near term, much of the volatility will be driven by investor perception of the ability of gateways to provide a reliable store to secure individual holdings.This week, Bitcoin broke through the 215 support level – declining almost 9% in a day.

Are the risks greater for a potential investor using P2P bitcoin lending platforms?

Bitcoin P2P platforms themselves do not pose more risk than a traditional P2P platform. However, the USP for the P2P lenders to use bitcoin is the ease (both in terms of time and cost) at which money can be transferred overseas. It is here that the risks inevitably begin to stack up. Lending money to borrowers in other countries makes AML and KYC checks nay on impossible. If time is indeed money, then the value saved by cutting out expensive bank fees needs to balance out the time-consuming and ultimately expensive process of vetting potential borrowers. Beware of interest rates that seem too good to be true… they usually are.

A lack of awareness to the risks involved for a potential investor is as dangerous a territory for all unregulated platforms as it is for the investor. P2P lending websites will always be judged by the worst platforms as much as they will the best. The clean, modern P2P cryptocurrency websites do not guarantee clean, modern loans. The regulatory-enforced investment warning signs that adorn the websites of British P2P and B2B lenders are notable in their absence on Bitcoin P2P lending websites. The risks of lending money abroad to markets with conventionally weak currencies should not be understated. If you are borrowing in a highly unstable currency and do not generate revenues in that currency then you create another risk: the exchange rate risk that the cost of the loan, which is unknown to the lender, cannot be met. So what’s the attraction for lenders? Unless they are Bitcoin based, then they are lending to receive an unknown return, which is likely to be less than they expect. To me this is unattractive.

Which platforms should investors be wary of?

Bitbond, based in Germany with offices in the UK and across Europe, specialise in facilitating bitcoin loans to small online business owners to secure funding to increase their inventories and/or revenue. Bitbond launched in July 2013. In its first year of trading it funded more than 180 loans worth over €36,000 ($48,000) to date, and has a user base of approximately 4,100 people from over 100 countries. The website claims that lenders receive an average interest rate of 13%. The loans available on their platform range from a 36 month, bitcoin equivalent to 156 USD loan at 21.3% to a Venezuelan borrower aiming to buy mining equipment, to Bitcoin-equivalent USD10000 loan to a German Borrower purchasing stock for his shop. Bitbond relies on debt collectors and prioritizes the creditworthiness of the applicant and the purpose of the loan, yet there are numerous questionable borrowers that still escape the net and make it to the platform.

BitLendingClub offer a similar service. The majority of their borrowers come from countries with a severely damaged economy, such as Venezuela or Argentina. The service is an alternative source of funding for individuals who don’t have bank accounts but have mobile telephones and are used to making mobile payments. Investors offer competing interests rates from which the borrower can choose to fund the project. A potential lender is left with the complex task of assessing loans where the risks are not homogenised. There doesn’t seem to be any regulation of what is posted on the platform, and the rudimentary risk calculations are very much a guideline rather than a science.

It would take a huge amount of luck to invest frequently and completely avoid a dud borrower. Interestingly, their statistics are given as raw data from which an investor must carry out an independent analysis. In short, these platforms are for experienced, tech-savvy investors, or somebody with few pennies going spare willing to help out an individual in another country, with the hope of seeing some sort of return.

The Bitbond model has been heralded by Cryptocoins News as the most secure way yet of avoiding some of the horror stories that have plagued sights such as BTCjam. The San Francisco-based company specialise in offering personal loans starting from 6.7% percent APR, yet in the same digital “breath” suspiciously offer lenders up to 19.3% APR on their loan. Once again, be wary of offers that seem too good to be true. Their mission statement to “make credit affordable and accessible” is based upon the “accepted wisdom” that interest rates for personal loans in developing countries can exceed 200% per year, choosing Brazil as an example. Brazil, along with India, has certainly been the poster boy for extortionate interest rates in the past, although the issue is certainly being addressed. BankFacil are at the forefront of a new generation of Brazilian financiers that offer secure finance to Brazilians, but still at rates of between 20-30%.

There are horror stories aplenty on internet forums that slate BTCJam: those alone should deter all but the most reckless investor. In an age where borrowing money through unconventional online platforms is more and more common, BTCjam certainly can command even more of a share of the market than they already have. By the end of 2014, BTCjam had facilitated bitcoin loans in excess of $10 million with 100,000 users in over 200 countries… a bold claim considering there are only 196 recognised countries in the world. Such minor discrepancies are important: transparency should be guaranteed, but in the convoluted world of cryptocurrency market places, a fine tooth comb and plenty of due diligence is necessary to enjoy any success as an investor. I for one would avoid them like the plague, impressive as the technology is. One of the good things about loans is that you know what you need to repay. Uncertainty is always unattractive to investors (equity and/or debt). The old maxim that as long as markets are moving somebody is making a profit is true, but only if you can go long and short and do so quickly. A true and perfect market simply doesn’t exist for bitcoin-based crowd loans… so invest at your peril.