ArchOver has teamed up with The Telegraph to produce a series of articles to help educate investors on the UK Peer-to-Peer Lending sector. In a brave new economic and financial world, understanding different ways of managing your money is key to success. P2P Lending can help both individuals and businesses navigate a post-Brexit world, with the reassurance that it is a secured and effective method of protecting and growing your money.

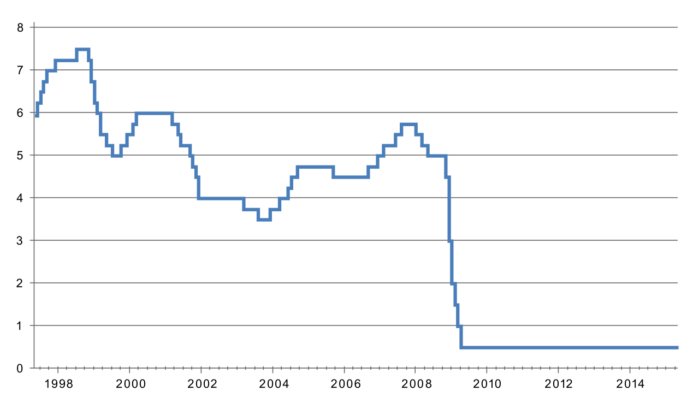

As interest rates dive, new ways of raising returns on cash are sparking interest.

With the Bank Rate at a record low of 0.25 per cent and those with cash looking for reasonable returns, the peer-to-peer (P2P) lending sector is receiving a boost.

P2P lending sites offer businesses the chance to borrow money from individuals in order to expand, bypassing difficult-to-obtain high-street bank loans and replacing inflexible and sometimes pernicious invoice discounting facilities.

Some lenders receive returns in excess of 7 per cent on P2P lending sites, but risk losing their cash if the business goes under. This is the issue that Angus Dent, chief executive of P2P platform ArchOver, believes he has addressed with a unique form of security for lenders.

Mr Dent, a chartered accountant and technology business expert, founded ArchOver after realising there was a gap in the market for medium-sized loans for growing businesses.

“If you needed a £50,000 overdraft you could probably get it from your bank and, if you needed more than £3m, you could approach a venture capitalist,” he says. “But there wasn’t any reasonable way you could raise, say, £500,000 or so for your business.

“We also saw there were an awful lot of people who had money on deposit that wasn’t doing very much. ArchOver aims to put those people together in a way that is rewarding for everyone. The name refers to our platform, which arches over from the people with cash to those who want to borrow.”

Loans made through the ArchOver platform are “secured and insured”, which Mr Dent says provides “unparalleled investor protection”. The security policy involves insuring each borrower’s accounts receivables – the money owed by their customers for goods and services that have already been delivered – against the loan.

The main reason why company borrowers don’t repay loans is because their customers don’t pay them. Credit insurance successfully mitigates this risk. Given that most of the borrowers take credit insurance from Coface – an A- credit-rated supplier with a very good record of meeting claims, which represents a significant safeguard for lenders.

Different types of lending provide different types of security, and different types of security offer different levels of liquidity. By securing loans on Accounts Receivable he believes the security is relatively easy to value and liquidate, meaning that the likelihood of getting your money back in the event of a disaster is high. This compares well with property, which is often held up to provide great security, but which is difficult to value and often illiquid. That said, lending should only form part of a diversified portfolio of investments. “We believe people are grown-ups and should do their homework on their investments,” he adds.

The minimum that an ArchOver user can lend to any one borrower is £1,000, an amount that he believes means people will carry out the correct amount of research. “Most people will take an investment of £1,000 seriously,” he says, suggesting ArchOver is suitable for those with a portfolio of different investments, including those people who are managing their retirement income. “Our oldest lender is 89,” he confides.

Lenders are encouraged to find out more about the company that they will be lending to, including the reason for borrowing the cash.

Some of the businesses that have borrowed from ArchOver have included timber frame restoration specialist TRC, healthcare service provider Spirit Healthcare and accountancy business Spain Brothers. In each case, the company found ArchOver offered a better service, a combination of lower price, much lighter touch processing and no personal guarantees than they could get from a bank or invoice discounter.

So far ArchOver has facilitated £22m of loans with no defaults or losses, and Mr Dent believes the uncertainties created by the Brexit vote could further increase demand for the product. “While some businesses will decide not to expand, others will need to find growth finance and, with interest rates at 0.25 per cent, there is more demand than ever from those with cash who are looking for new ways to make their money work for them.”