On this blog, I have already discussed my issues with the word “Fintech”. The umbrella term just covers too many businesses in different sectors to justify the sweeping generalisations that tend to accompany it. A comparison close to home would be to tie in all the various forms of investment management and define them by the characteristics of the most aggressive hedge fund in the pack. Unfortunately, the hype surrounding “FinTech” means a fragile bubble is increasingly stretching across multiple sectors, and the possibility that one of them will blow up will mean the mess lands at the door of everybody else. There’s no doubt that such hype is irresponsible and can be misleading, and Mark Tluszcz’s article published in the Financial Times yesterday is an example of the misinformation peddled as a result.

Tluszcz works for a Luxembourg-based Venture Capital firm and was an early stage investor in Skype, a business whose growth, albeit in a virgin field, was absolutely staggering. Therefore, I find it extraordinary that he uses Skype as the benchmark to judge whether “Fintech” has had an equivalent breakthrough- there really aren’t many equivalents out there at all! Interestingly, he uses Amazon as his other example: let’s not forget that their unorthodox business model led many to believe that a 5-year old Amazon barely justified the hype surrounding it all, particularly when taking into account its lack of profit. Most FinTech platforms have been around for less time, certainly in the Peer-to-Peer Lending space that was born largely from the flames of the 2008/2009 financial crisis. And for the basis of my response, I will be focusing on P2P Lending, as Tluszcz suggests that is the area of Fintech that everybody needs to be most worried about…

Firstly, anybody that suggests that P2P Lending carries more risk than equity crowdfunding and poses a threat akin to the subprime mortgage crisis clearly does not understand the fundamental principles about what P2P Lending is all about. From ArchOver’s perspective, we have yet to have a default on one of our loans and our lenders are comfortable that our “secured and insured” model provides them with robust security. Indeed, the whole Peer to Peer lending industry is leaps and bounds ahead of equity crowdfunding in that regard; just take a look at some of the provision funds on offer with providers such as RateSetter, where no investor has lost their money to date. The reason? We go through rigorous due diligence checks that involve monthly monitoring and client visits, not to mention the weight of the credit analysis independently provided by the Credit Insurance providers. Tluszcz suggests that the benchmark for success in our industry is purely “speed and volume”. That just isn’t the case: yes, it’s important to grow, but the businesses and HNWI that invest in, own or lend across P2P platforms just would not stand for such reckless abandon. Hampden Group, who back ArchOver, have a far more long term outlook than Mr Tluszcz seems to suggest, and the quality of our borrowers must reflect that.

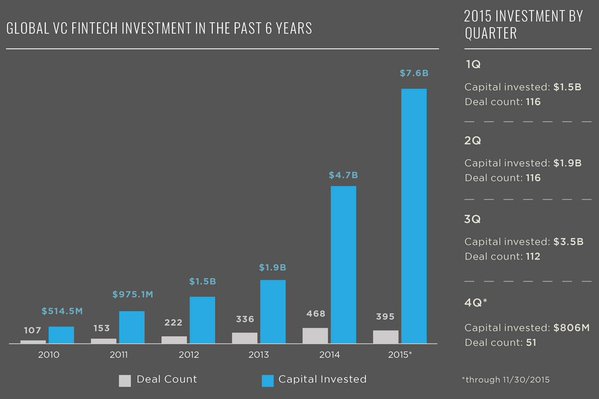

Alluding to the subprime crisis, as Turner did last month in the FT, shows a lack of understanding as to the key mechanics behind the Crash: borrow short, lend long. Peer to peer loans are matched, with investors lending money to borrowers on fixed terms. Investors/lenders are fully aware of the risks involved with lending, and if there was another economic apocalypse such as in 2009, it would be some of those investments they might lose; there certainly would not be an unfair bail out by the taxpayers to atone for the mistakes of greedy bankers. And to even mention Lonon’s Fintech “scene” in the same breath as the enormous $7.6 billion Ponzi scheme ran by China’s Ezubao shows enormous disrespect, firstly to the UK’s financial regulatory bodies who are in the process of regulating the P2P Lending industry, and secondly to the Government who have introduced the Innovative Finance Isa to help investors benefit from lending directly to UK SMEs. Greater regulation is on the way; it is hardly the fault of the Peer to Peer Lenders who are waiting patiently for the FCA to finish what is an understandably long and arduous process.

It seems to me that at the heart of Tluszcz’s disdain for P2P Lending is what he perceives as a lack of true innovation. It isn’t “different” enough, so it is merely a “mirage” that isn’t worth the capital invested. He doesn’t take into account the service provided for lenders, who wish for an increase on the measly interest offered by the banks but without having to dip into the risky and complicated world of stocks and shares. And he certainly doesn’t acknowledge the reality that the banks haven’t got the drive to facilitate lending to UK small businesses: the middle office bank manager has been axed, and Basel III means that money previously available for lending must now be held in reserve. The result? Costly, inflexible, lengthy, process-laden finance that just cannot keep up with the range of options provided by specialist SME alternative finance providers. And as SMEs drive the UK economy, the fallout is far-reaching. The banks understand, and are starting to come round to the idea of working together: already banks lend money from their balance sheets across platforms, joining other institutional lenders such as family offices, schools and councils in doing so. Criticism of Fintech will grow in tandem with unnecessary hype; however, in the meantime, Fintech will continue to innovate alongside the traditional institutions.