What does the future hold for Crowdlending the “Chinese Way?”

What does the future hold for Crowdlending the “Chinese Way?”

Min Ding and Jie Xu’s anthropological book The Chinese Way (Routledge, 2014) gives an insight into how the modern Chinese way of life has catapulted the country to superpower status, built upon the stories of around a thousand figures from academia, business and government.

http://www.tradingeconomics.com/china/gdp-growth-annual http://www.tradingeconomics.com/china/gdp-growth-annual |

Central to the book is the concept of “guanxi”, roughly translated as “connections”, mutually beneficial relationships developed face to face in an informal manner that are crucial in forging successful business partnerships. These customs are heavily engrained in the rich tapestry of Chinese culture, yet the elitism, under-handedness and cronyism that “guanxi” inevitably produces is one that sits uncomfortably alongside Maoism and the subsequent governance of the CPC, which championed social equality above all else.

Modern China has seen the government make “communism” and “capitalism” an unlikely couple: prominent Special Economic Zones have allowed capitalism to prosper and business to flourish, whilst the one party state maintains its grip on power. Yet “guanxi” remains at the heart of modern business. It rewards those with connections and restricts those without. That is reflected all the way through to those seeking a loan. That is where the internet, and crowdfunding and crowdlending in particular, have turned “guanxi” on its head.

|

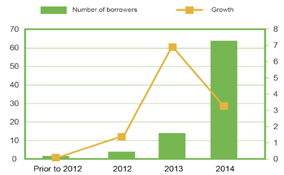

Crowdlending is still a fresh and relatively new idea in China (first initiated in June 2007), but it is growing rapidly. P2P lending has had a positive impact on a variety of businesses allowed to prosper within China, especially smaller businesses that previously struggled to obtain loans from the Chinese banks. Smaller Chinese businesses have created a surplus of demand for credit; it is from here that P2P platforms have been able to flood the market with cheaper finance options. The number of platforms have jumped from 50 just three years ago to around 1575 platforms now. Despite P2P lending’s current success in China, this was not always the case. During the earliest stages of Chinese P2P platforms, transparency was a major issue. The resultant effect was funding across multiple platforms from private lenders to an unreliable sources who eventually defaulted. Platforms tried to respond by reducing the amount of credit that could be lent to borrowers. Unfortunately, this only created additional problems as debtors who intended to pay their owed sum by borrowing a larger amount of money could no longer do this, causing further defaults across a variety of platforms resulting in millions of loans becoming unrecoverable.

Lufax (lufax.com) currently holds the title of being China’s largest P2P lender. Historically, however, even Lufax was dogged by reliability issues. Their company were ‘blacklisted’ by Dagong Global Credit Rating, suggesting their disclosed debtor information was insufficient. Recurrent platform reliability issues threatened their place in the market, as private lenders became reluctant to lend their money at all, knowing there was a large possibility they may not get any of it back. Even now the issue of loan security exists; there is still an approximate 35.0% default rate suggesting that China is yet to completely resolve the issue.

However, there has been a steep learning curve since then. Post 2011, the Chinese began utilising the PBoC’s Credit Reference Centre and Nationwide P2P credit information system, restricting their lending to businesses situated geographically nearby. This allowed them to obtain valuable information such as the borrower’s use of funding and financial figures, decreasing the risk of P2P services by ensuring that borrowing companies could pay their debt back. Despite initial faults in the system, private lenders are now increasingly confident in the platforms over the following years, with the number or investors rising to 500,000 and over 81.8 billion yen (over 419 million pounds) being lent in the first half of 2014. Whilst President XI continues his mission to ruthlessly dispose of anyone seen to have cheated the system through greed, bribery and corruption, maybe it will be the organic growth of crowdlending that renders “guanxi” obsolete and continues to drive the country forward as a 21st Century superpower.

| http://www.tradingeconomics.com/china/gdp-growth-annual |