What is the Investment Plan?

Too busy or not inclined to build your own portfolio? No problem. With ArchOver's Investment Plan, you can invest into a portfolio of loans and at a lower threshold.

In practice, the Investment Plan will be invested into the first 10 Secured projects which appear on our platform after the Plan draws down. No more than 10% of your portfolio will be invested into any one Borrower business. As the Plan develops, your funds will be re-invested into new projects as long as their terms fit with the Plan’s term. Each Plan has a target term of 26 months; this is to incorporate an initial deployment period, and to maximise the amount of interest that could be earned.

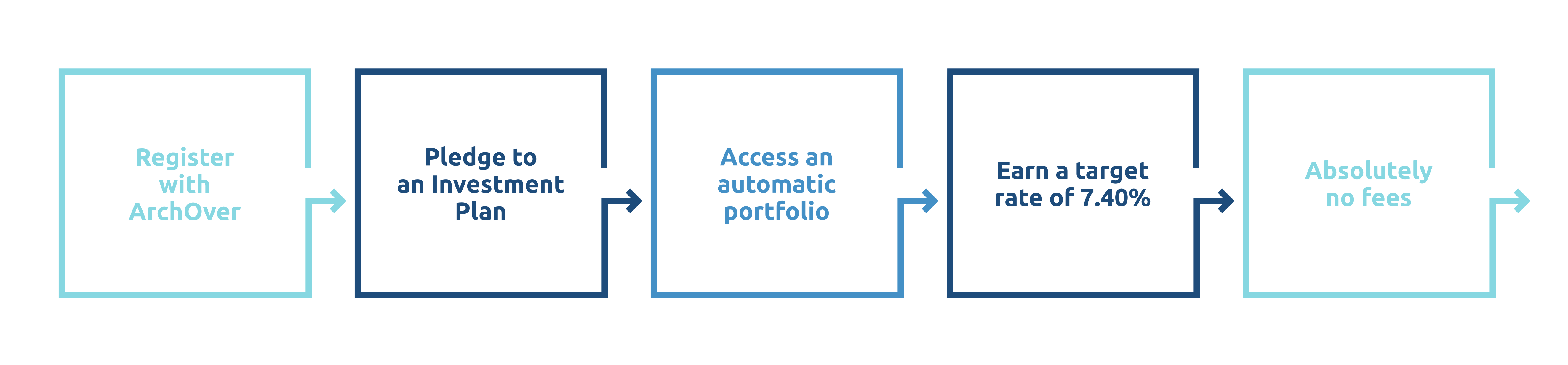

How it works

- Invest in a portfolio of Secured loans to 10 different businesses

- Receive monthly interest over a period of 26 months

- Invest from £250

- Benefit from ArchOver's stringent credit approval process

- Earn a target rate of 7.40% p.a.

- No fees whatsoever

Forecast lender rates have been input between 8.00% and 8.50%. Any lag (where the Investment Plan is waiting to be fully deployed) has been factored in on a case-by-case basis.

Lenders: Don’t invest unless you’re prepared to lose money. This is a high-risk investment. You may not be able to access your money easily and are unlikely to be protected if something goes wrong. Interest payments are not guaranteed, if the Borrower defaults we offer no assurances that capital can be recovered. Historic returns and loan default rates are not necessarily indicative of future returns and future default rates. ISA eligibility does not guarantee returns or protect you from losses. Lending over the ArchOver platform is not covered by the Financial Services Compensation Scheme. Take two minutes to learn more and please read our P2P Guide .

ArchOver Limited is a company registered in England and Wales with company number 07235487. ArchOver Limited is authorised and regulated by the Financial Conduct Authority (Reg No: 723755).